DAMITT Q2 2019: New Industry Analysis Sheds Light on Significant Investigations By Sector

Fast Facts

United States

- U.S. antitrust enforcement agencies concluded 20 “significant investigations” during the rolling-twelve months (RTM) ended Q2 2019, down from 28 for the RTM ended Q2 2018.

- These significant investigations took an average of 11.4 months from announcement to completion for the RTM ended Q2 2019, compared to 9.9 months in the RTM ended Q2 2018.

- More of these significant investigations had vertical issues. A full 25 percent of significant investigations for the RTM ended Q2 2019 had vertical aspects, compared to 18 percent for the RTM ended Q2 2018.

- DOJ has been more successful than the FTC in streamlining significant investigations. More than 80 percent of DOJ’s H1 2019 significant investigations lasted fewer than 10 months, while 75 percent of the FTC’s significant investigations lasted more than 16 months and only one lasted fewer than 10 months.

- New DAMITT industry data show that the Healthcare & Pharmaceuticals industry keeps the U.S. agencies the busiest, accounting for nearly a third of the significant investigations since 2011; but the Technology industry has recently spiked higher, accounting for 40 percent of H1 2019 activity.

Europe

- The EU Commission concluded 29 “significant investigations” during the RTM ended Q2 2019, up 20 percent from the RTM ended Q2 2018.

- The average duration of Phase II investigations resolved in the RTM ended Q2 2019 and the prior RTM remained steady at 13.3 months; whereas the average duration of significant Phase I investigations resolved in the RTM ended Q2 2019 was 8.5 months, compared to 7.1 months in the RTM ended Q2 2018.

- Three transactions have been prohibited so far in 2019—the highest number for any year since 2001. But this does not necessarily reflect increased enforcement vigor given that the blocked transactions reportedly involved highly concentrated industries.

- Transactions involving Industrial Products & Services have accounted for the largest proportion of significant investigations since 2011 (32 percent), followed by the Healthcare & Pharmaceuticals industry (12 percent). Ninety percent of significant healthcare investigations were resolved in Phase I, in part due to the Commission’s extensive body of published decisions, which facilitates faster reviews.

- Over the 2011-2019 period tracked by DAMITT, 90 percent of significant transactions in the Healthcare & Pharmaceuticals sector were cleared in Phase I.

The Dechert Antitrust Merger Investigation Timing Tracker (DAMITT) is a quarterly release from Dechert LLP reporting on trends in significant merger control investigations in the United States (U.S.) and European Union (EU).

In the U.S., “significant” merger investigations include Hart-Scott-Rodino (HSR) Act reportable transactions for which the result of the investigation by the Federal Trade Commission (FTC) or the Antitrust Division of the Department of Justice (DOJ) is a consent order, a complaint challenging the transaction, an official closing statement by the reviewing antitrust agency, or the abandonment of the transaction with the antitrust agency issuing a press release.

In light of the procedural differences between the EU and U.S., DAMITT defines “significant” EU merger investigations to include transactions subject to the EU Merger Regulation and resulting in either Phase I remedies or the initiation of a Phase II investigation.

DAMITT calculates the durations of significant investigations in both jurisdictions from the date of deal announcement to the completion of the investigation, which therefore includes the time attributable to all pre-notification/consultation efforts.

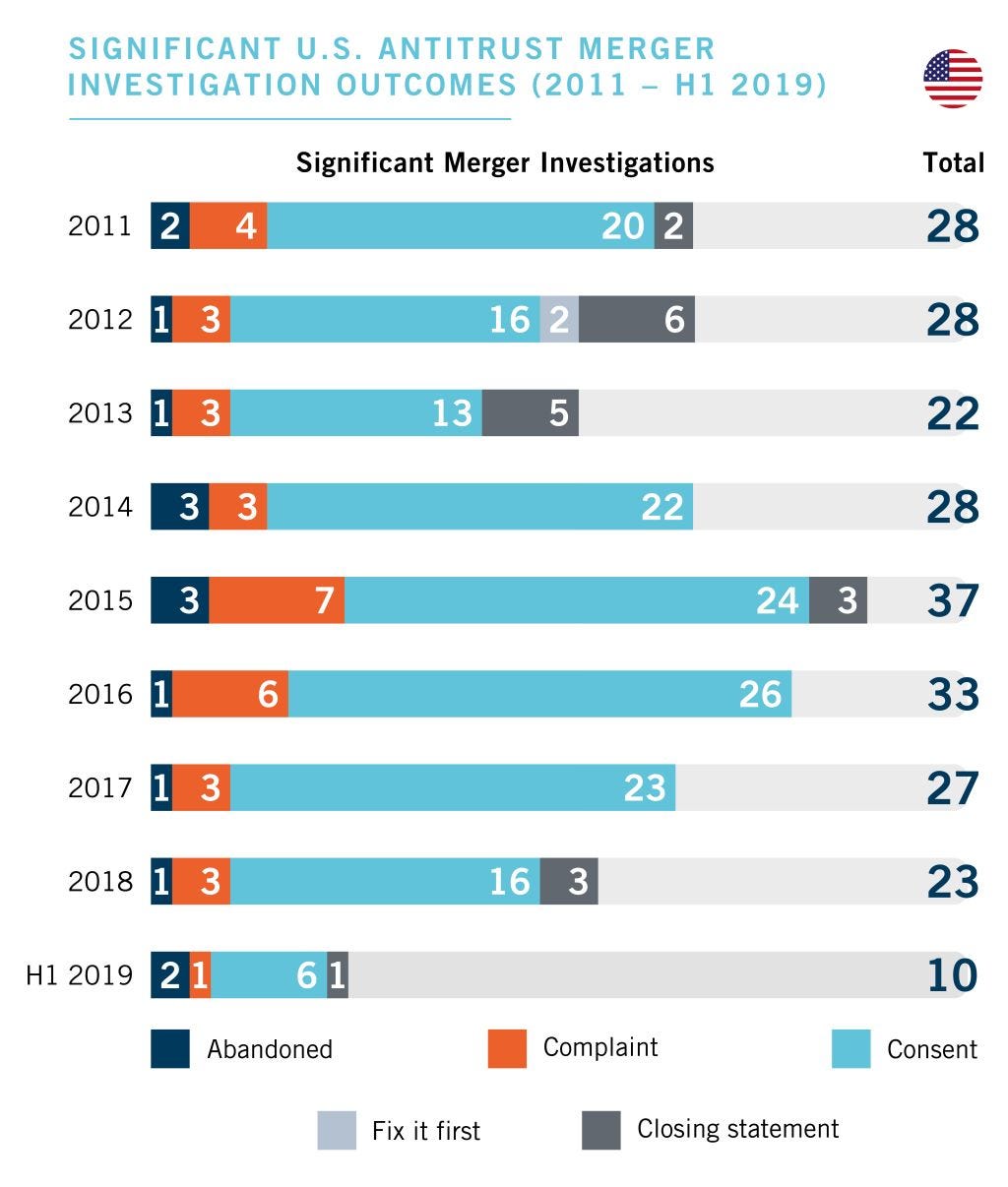

Number of Significant US Merger Investigations and Complaints Declines

The U.S. antitrust agencies concluded 10 significant merger investigations in H1 2019, compared to 13 in H1 2018. The 20 significant U.S. merger investigations concluded by the DOJ and FTC over the RTM ended Q2 2019 reflected a decline of nearly 30 percent from the 28 that were concluded during the RTM ended Q2 2018.

Over the 12 months ended Q2 2019, only one significant merger investigation (Quad Graphics/LSC Communications) resulted in a complaint seeking to block the transaction, compared to the five complaints that were filed in the prior 12-month period. However, two deals — Securus Technologies/Inmate Calling Solutions and Republic National/Breakthru Beverage — were abandoned in Q2 2019 in the face of litigation threats by the agencies, compared to one abandonment in 2018.

The relative frequency with which U.S. significant investigations raise vertical issues continues to increase. Vertical issues arose in 30 percent of significant investigations in H1 2019, compared to 23 percent in H1 2018. For the RTM ended Q2 2019, the comparable figure was 25 percent, up from 18 percent in the RTM ended Q2 2018.

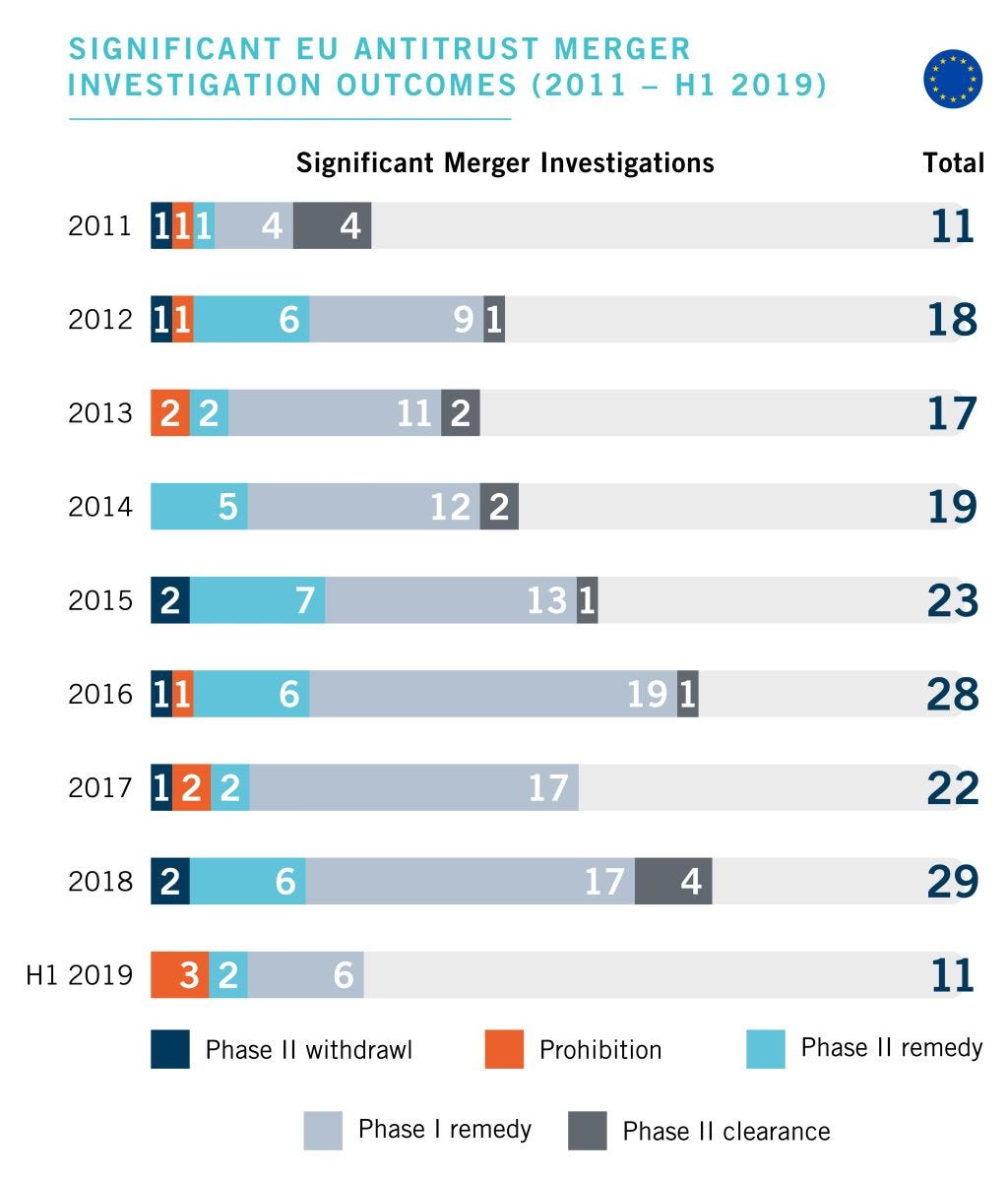

Number of Significant EU Investigations on Pace with 2018

The EU Commission concluded three significant EU merger investigations in Q2 2019, bringing the total number for H1 2019 to 11. This count is in line with H1 2018 and on pace to match the average of 21 significant merger investigations per year over the 2011-2018 period tracked by DAMITT.

Two of the three significant EU merger investigations resolved in Q2 2019 were cleared with remedies, including one transaction in Phase I and one transaction in Phase II. The remaining transaction, Tata Steel/Thyssenkrupp/JV, was prohibited following a Phase II investigation, which brings the total number of transactions that have been blocked so far in 2019 up to three.

This is already the highest number of prohibitions in any year since the EU Commission suffered a series of damaging reversals in the EU courts in 2002, and the annulment of three prohibition decisions. The multiple prohibitions may, however, not necessarily reflect an increased vigor of enforcement. It is possible that the cases were challenging (each of the three transactions reportedly would have led to the creation of market leaders in already highly concentrated industries), or that the parties were not willing to offer remedies satisfactory to the Commission.

Additionally, it bears noting that two of the transactions (Wieland/Aurubis and Tata Steel/Thyssenkrupp/JV) were notified following mergers involving their respective competitors. So the key takeaway from these transactions is perhaps that there may be a first-mover advantage in a consolidating industry: the EU Commission operates a priority principle by which the first transaction to be notified will be assessed as if there were no second transaction pending. By contrast, U.S. authorities do not apply a strict priority principle, and may in some circumstances assess the impact of multiple pending transactions in combination.

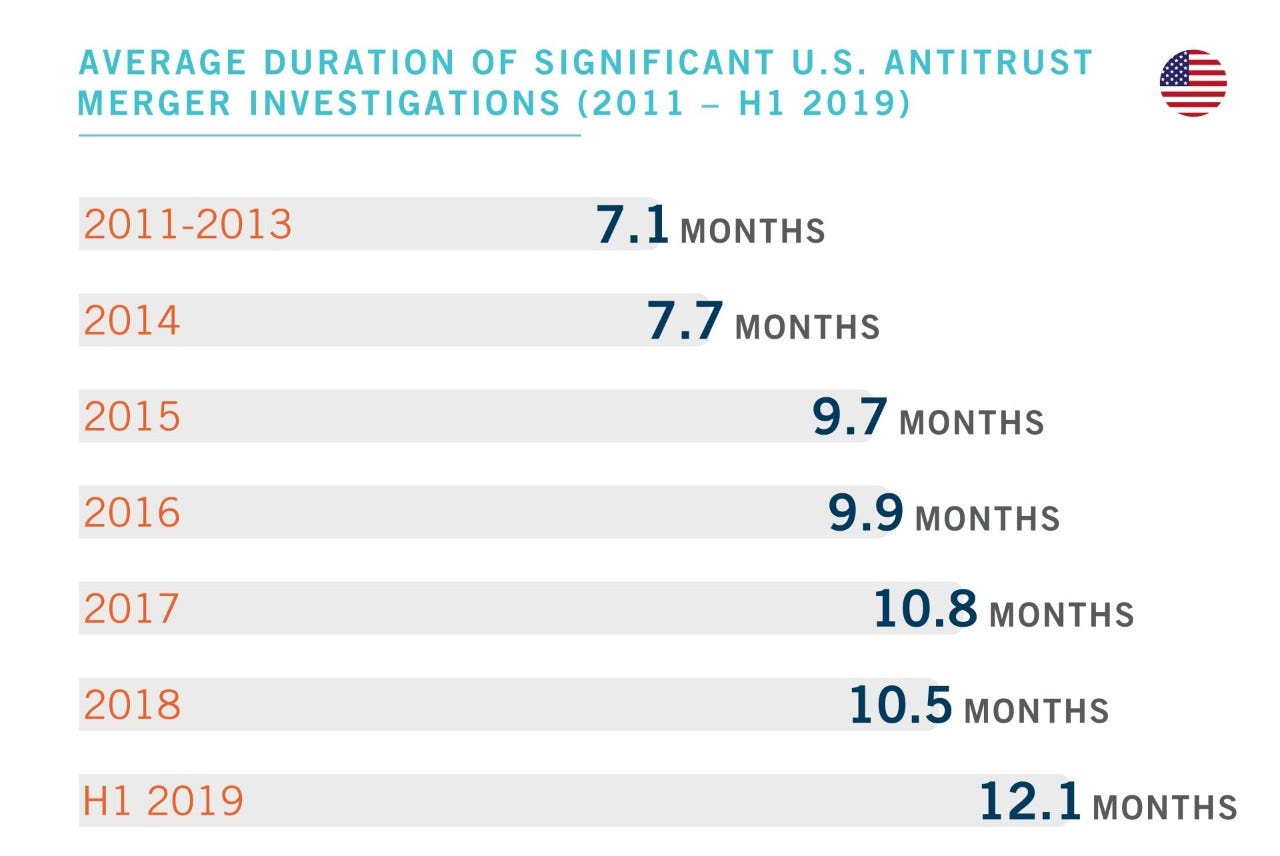

Duration of Significant US Investigations Continues to Increase

The length of significant U.S. investigations continues to rise. For H1 2019, the average duration from the announcement of the deal to the conclusion of the investigation was 12.1 months, up from 10.2 months in H1 2018. For the RTM ended Q2 2019, the average was 11.4 months, up from 9.9 months in the RTM ended Q2 2018.

At nearly 19 months, UnitedHealth’s acquisition of DaVita Medical Group provoked the longest significant U.S. merger investigation concluded in H1 2019 and the eighth-longest since 2011.

Significant U.S. investigations with vertical aspects concluding in H1 2019 averaged about 15.3 months, compared to 10.8 months for the remainder of deals concluding in H1 2019. These H1 2019 results align with DAMITT’s prior finding that significant U.S. investigations with vertical aspects tend to last longer on average than those without vertical aspects.

Citing DAMITT findings, both the U.S. DOJ and FTC announced planned reforms to the merger review process in late 2018. To date, DOJ has made strides with its reforms in shortening the review process, as more than 80 percent of DOJ’s H1 2019 significant investigations lasted fewer than ten months. In marked contrast, however, 75 percent of the FTC’s significant investigations concluded during H1 2019 lasted more than 16 months and only one lasted fewer than ten months. DAMITT will continue to observe whether this clear difference in duration between the two federal agencies continues to hold in future months.

While prior DAMITT analyses found that antitrust merger litigation added an additional five to seven months to the merger process, no merger litigations have completed during H1 2019. The only significant U.S. investigation resulting in a complaint during H1 2019 (Quad Graphics/LSC Communications) was filed by DOJ on June 26, 2019 and a trial on the legality of the merger was scheduled to begin on November 14, 2019 —which is 148 days later.

In comparison, antitrust merger cases commenced between 2015 and 2018 started on average about 107 days after the complaint was filed. Although Quad and LSC have since abandoned their transaction, the scheduled litigation was atypical in that if the merger had been deemed unlawful by the court, the judge had ordered the parties to establish a separate case schedule for a hearing on any remedy proposed by the merging companies. If followed by other courts, this bifurcation would make it even more difficult for companies proposing a merger remedy to hold their deals together through a lengthy investigation, lengthy litigation on the legality of the merger, and additional litigation over any proposed remedy.

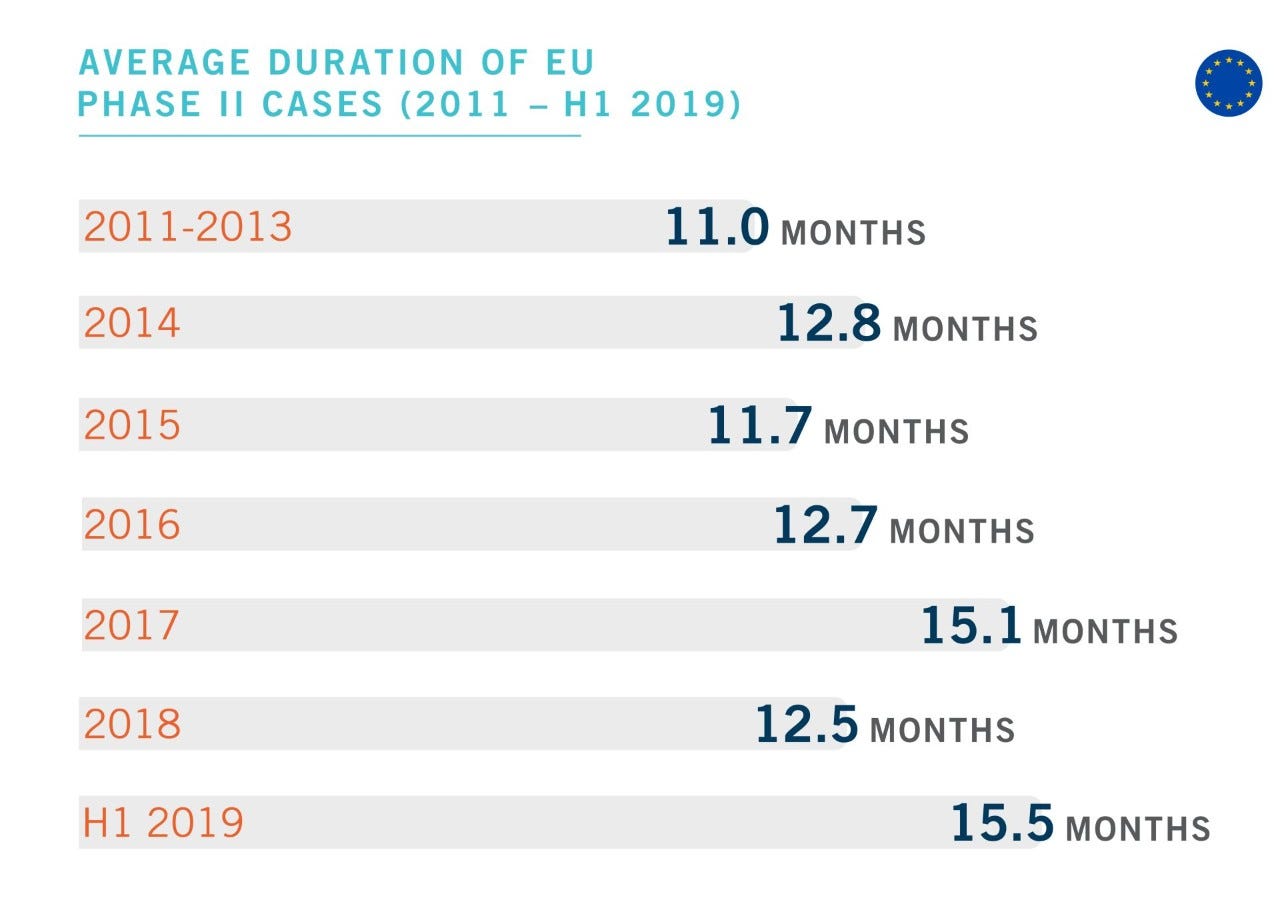

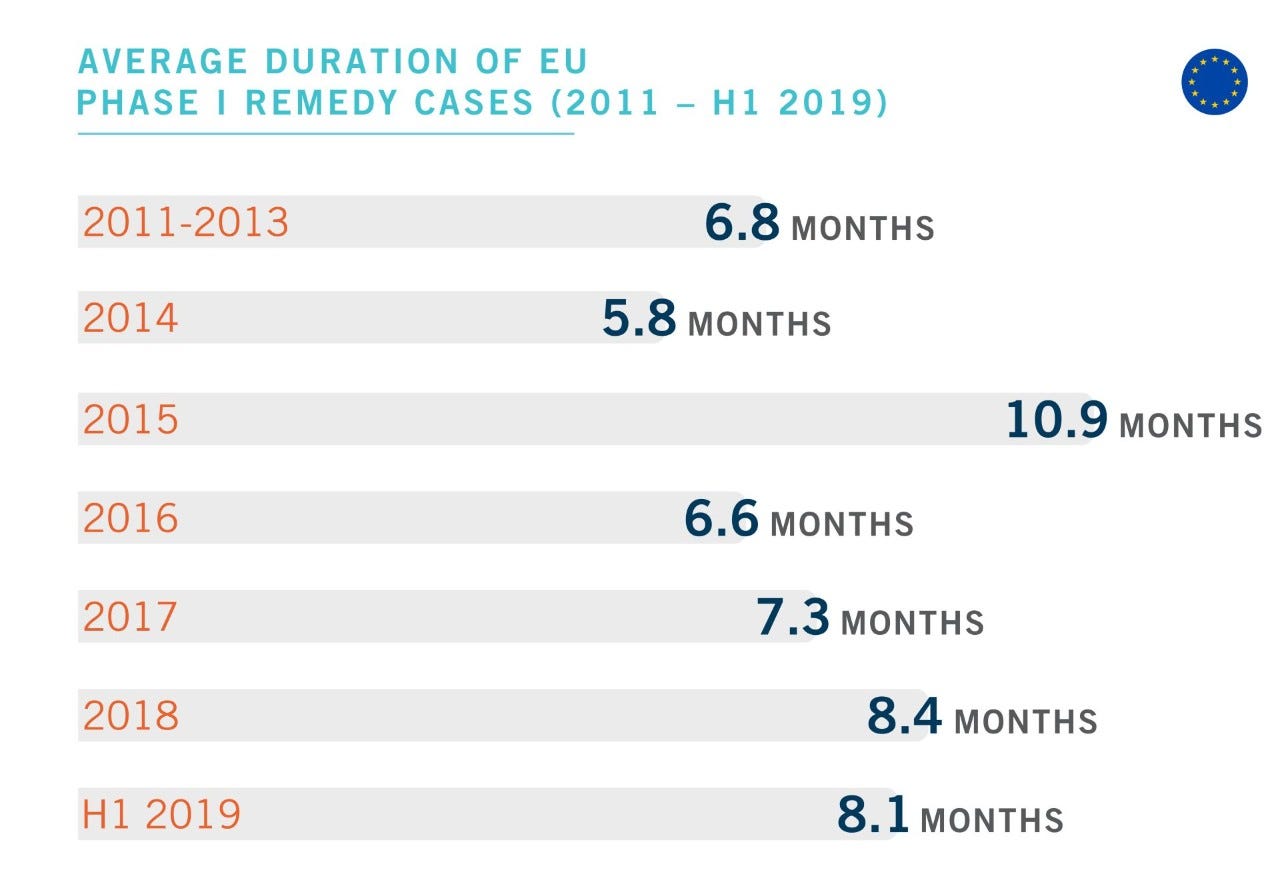

Duration of EU Phase II Cases Remains Constant but Phase I Remedy Cases Taking Longer

The duration of significant Phase I remedy cases continues to increase: the average duration of investigations resolved over the RTM ended Q2 2019 – 8.5 months – is up 20 percent from the prior RTM period.

The average duration of Phase II proceedings concluded in the RTM ended Q2 2019 remained constant at 13.3 months compared to the prior RTM period, although there was a sharp increase in the average duration of Phase II investigations resolved in H1 2019 from the average in 2018.

EU Phase II Proceedings

The 15.5-month average duration for Phase II proceedings resolved in H1 2019 is about three months longer than the 2018 average of 12.5 months, and longer even than the 2017 record of 15.1 months. This increase is likely related to three complex Phase II investigations that were concluded in H1 2019 (BASF/Solvay’s EP and P&I Business, Siemens/Alstom and Tata Steel/Thyssenkrupp/JV), for which the average duration was nearly 18 months. Indeed, the review of Tata Steel/Thyssenkrupp/JV took nearly 21 months from announcement to prohibition, making it the third longest investigation in the 2011-H1 2019 period tracked by DAMITT.

Notwithstanding the higher H1 2019 average duration, Phase II investigations concluded during the RTM ended Q2 2019 averaged 13.3 months, which is in line with the previous RTM period.

The average time between the announcement and notification of Phase II transactions resolved during the RTM ended Q2 2019 was 6.1 months, which is broadly in line with the average of 6.5 months in the prior RTM period. Tata Steel/Thyssenkrupp/JV had an unusually long pre-notification period of 12 months; excluding that deal would bring the H1 2019 average of 7.7 months from announcement to notification (an increase of almost two months from the 2018 average) down to a more typical 6.6 months.

Article 10(3) of the EU Merger Regulation allows merging companies to grant “voluntary” extensions of time. These extensions are commonly conceded by merging parties at the urging of staff. Both Phase II investigations concluded in Q2 2019 entailed the use of such extensions, adding the statutory maximum 20 working days to the investigation period. This is consistent with the pattern of the maximum possible extension being invoked over the 2011-2018 period tracked by DAMITT.

EU Phase I Remedy Cases

On average, Phase I remedy cases in H1 2019 lasted 8.1 months, slightly down from the 2018 average of 8.4 months. However, the average duration of investigations concluded in the RTM ended Q2 2019 of 8.5 months is 20 percent longer than those concluded in the previous RTM period. This suggests that the trend of year-on-year increases observed since 2016 continues unabated. Phase I investigations resolved with remedies now tend to require more than five times the theoretical duration of the fixed timetable under the EU Merger Regulation.

The average duration of pre-notification contacts (i.e., from announcement until notification) mirrored the increase in the overall duration. The average of 6.7 months in pre-notification for Phase I remedy cases resolved in the RTM ended in Q2 2019 represents an increase of 26 percent in comparison to the prior RTM period. This confirms the importance of the pre-notification phase during which companies engage in extensive discussions with the case team over the scope and detail of their filing, thus adding time far in excess of the statutory timetable.

New DAMITT Analysis Reveals Which Industries Account for the Most and Longest Significant Investigations in the US and EU

For the first time, DAMITT analyzed trends involving the relative frequency and average duration of significant investigations by industry.

This analysis revealed that the Healthcare & Pharmaceuticals industry accounted for the highest number of significant investigations in the U.S. and the second most in the EU between 2011 and H1 2019. Over the same period, the Industrial Products & Services sector accounted for the highest number of significant investigations in the EU and fourth most in the U.S. Meanwhile, the Financial Services industry represented the second-lowest number of significant investigations in both the U.S. and EU.

DAMITT also observed that significant investigations from 2011 to H1 2019 involving the Chemicals industry lasted the longest on average in the U.S. and the second longest in the EU for both Phase I remedy and Phase II cases, behind only the Energy sector. At the other end of the spectrum, significant investigations in the Transportation industry had the second-fastest U.S. average, the fastest Phase I remedy EU average, and the second-fastest Phase II EU average.

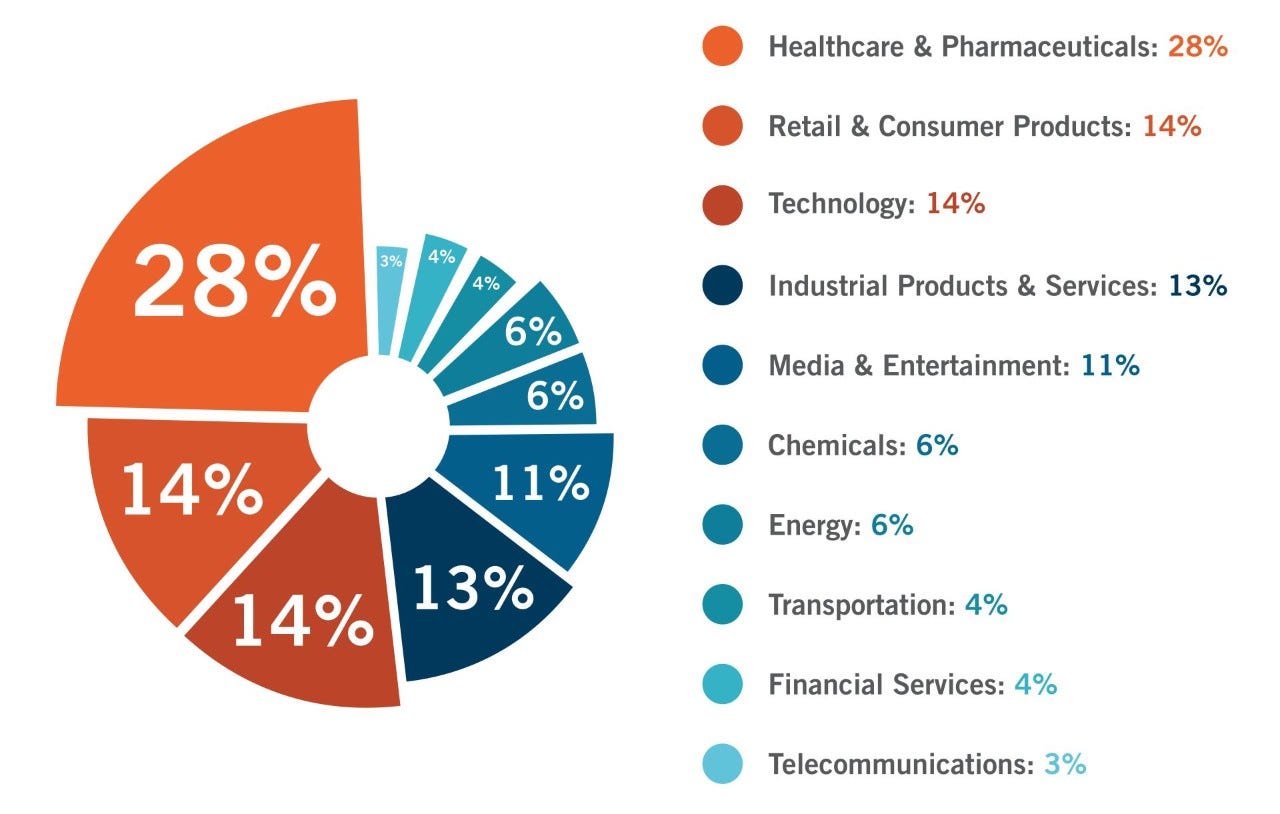

In the US, Healthcare & Pharmaceuticals Busiest Since 2011, Though Technology Industry Spiking Higher in H1 2019

The Healthcare & Pharmaceuticals industry has kept the U.S. antitrust agencies the busiest since 2011, accounting for about 28 percent of U.S. significant investigations. The Retail & Consumer Products and Technology industries are tied for second at 14 percent of significant investigations, followed closely by Industrial Products & Services at 13 percent.

Significant investigation levels by industry have been relatively consistent over time. In comparing the first half of the period tracked by DAMITT(2011-2014) with the second half (2015-H1 2019), DAMITT observes that only one industry (Chemicals) has seen a change in relative frequency of more than 3 percentage points between the two time periods. However, the Technology industry has seen a much more significant spike this year, accounting for about 40 percent of significant U.S. merger investigations in H1 2019 after remaining below 15 percent in each of the six prior calendar years.

Percent of Significant U.S. Merger Investigations by Industry (2011 - H1 2019)

The average duration of significant U.S. investigations has varied significantly by industry. Since 2011, Chemical industry mergers have taken the longest at 12.3 months on average. By comparison, significant investigations in the Financial Services and Transportation industries have taken only about half as long, averaging 6.0 and 6.4 months, respectively.

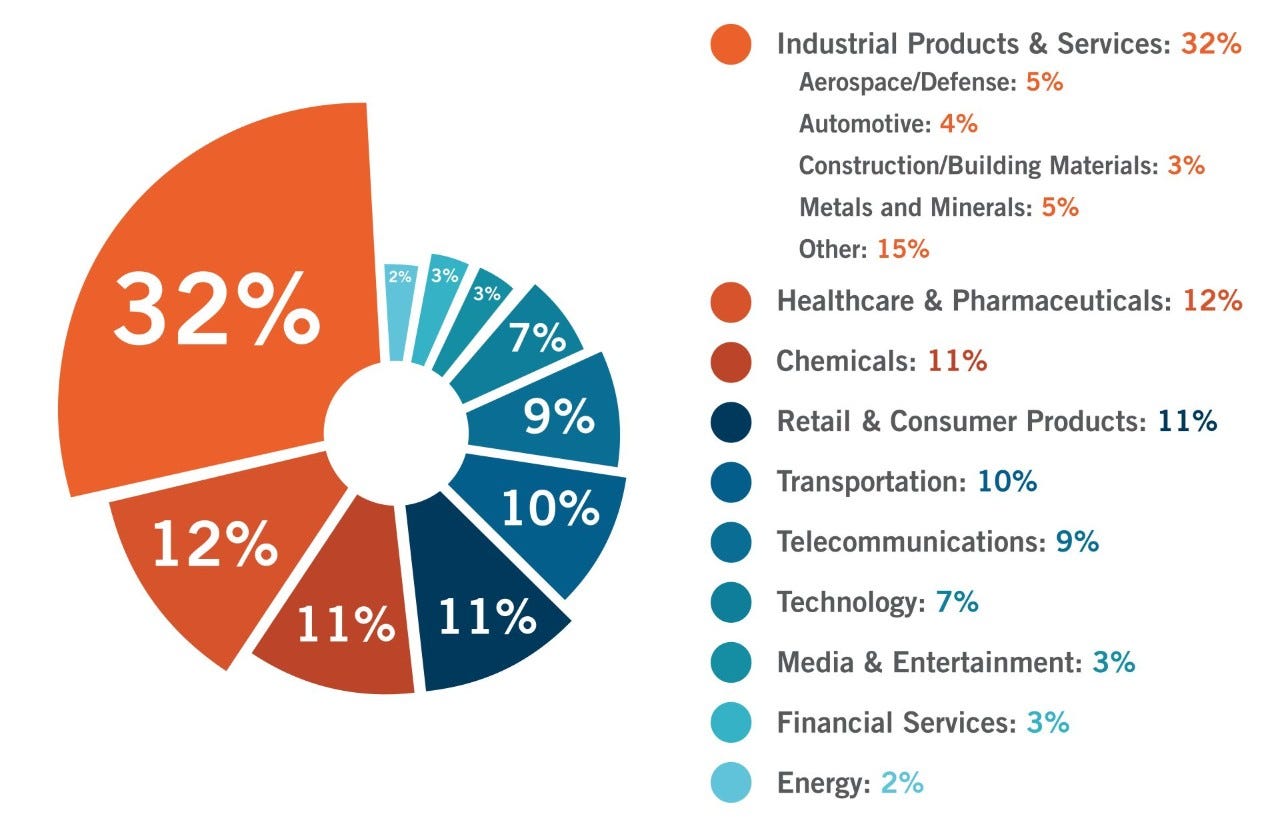

In the EU, DAMITT Observes Sectoral Variations for Phase I and II Clearances; 90% of Significant Investigations in the Healthcare & Pharmaceuticals Sector are Resolved in Phase I with Remedy Compared to only 25% in the Telecommunication Sector

Transactions in the Industrial Products & Services sector have accounted for the largest portion (32 percent) of EU significant investigations since 2011. This sector includes transactions in a number of sub-sectors that have witnessed significant enforcement activity in the EU, such as Metals and Minerals and Construction/Building Materials. The Healthcare & Pharmaceuticals industry had the second-highest level of activity, accounting for 12 percent of EU significant investigations. Retail & Consumer Products and Chemicals transactions tied for the third place, representing 11 percent of EU significant investigations.

Percent of Significant EU Merger Investigations by Industry (2011 – H1 2019)

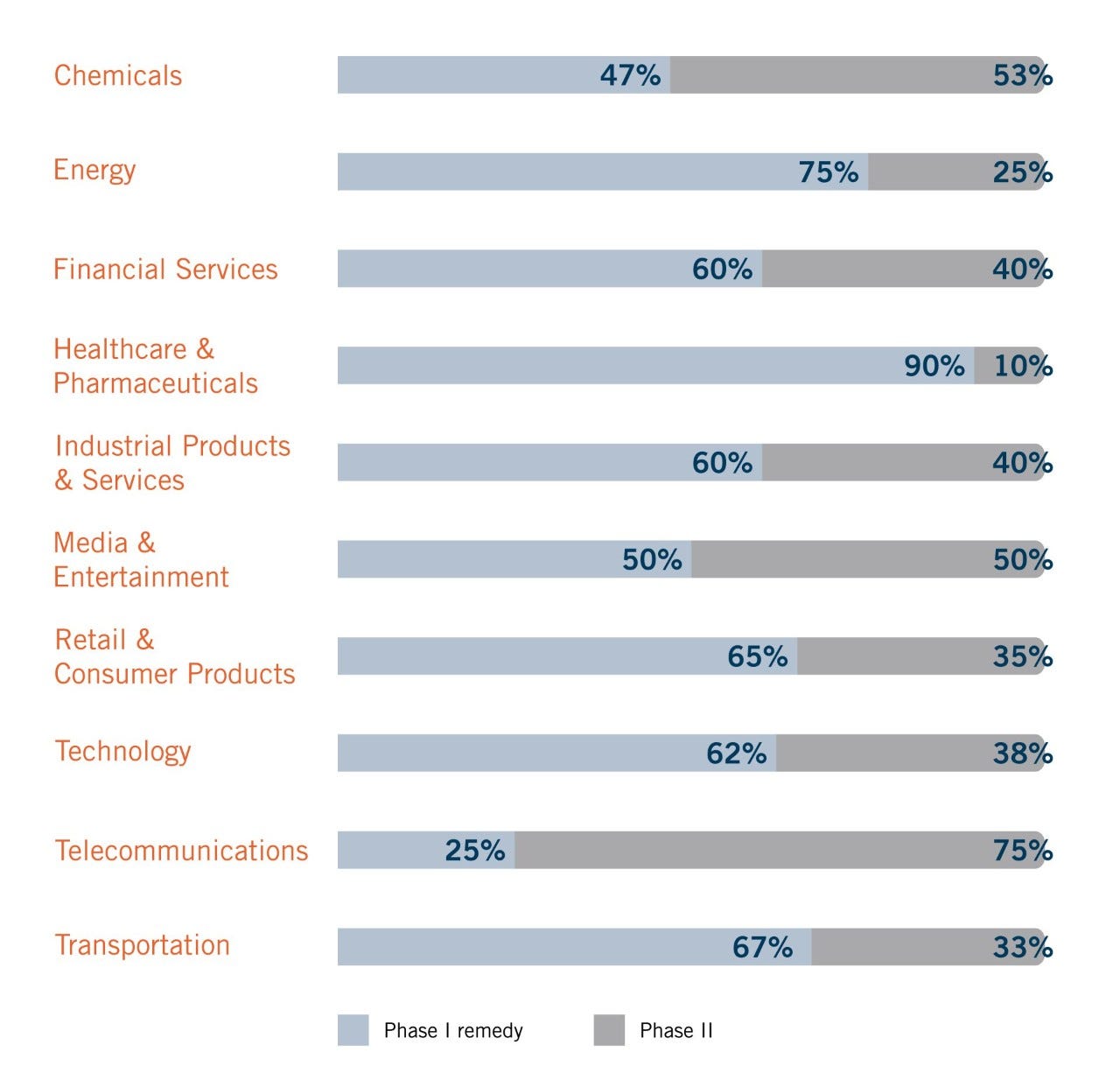

The breakdown of the data between significant Phase I and Phase II investigations reveals differences in the proportion of Phase II investigations across industries. For instance, over the 2011-H1 2019 period tracked by DAMITT, 90 percent of significant EU merger investigations in the Healthcare & Pharmaceuticals sector were resolved in Phase I with remedies; whereas 75 percent of significant transactions in the Telecommunications sector underwent a Phase II investigation. The established decisional practice of the EU Commission in a number of sectors (e.g., Healthcare & Pharmaceuticals and Transportation) is likely a facilitating factor, allowing parties to identify potential issues and remedies early on.

Breakdown of EU Phase I Remedy vs. Phase II Cases by Industry (2011 – H1 2019)

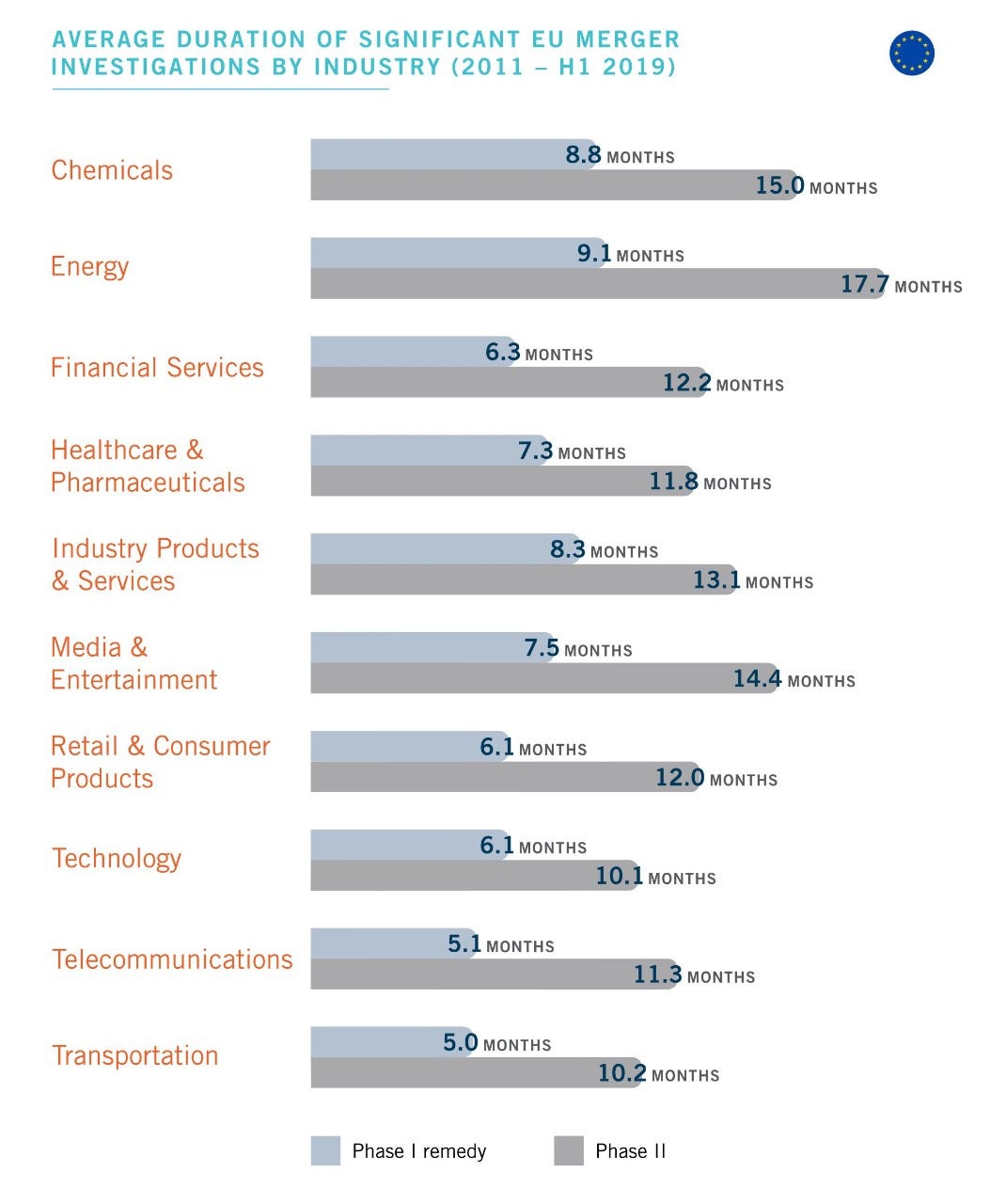

A review of the average duration of significant Phase I and Phase II investigations by industry highlights substantial timing differences. The Energy sector accounted for the longest average duration in both Phase I and Phase II cases at 9.1 and 17.7 months, respectively.

Within the Industrial Products & Services category, cases involving Construction/Building Materials stood out for their great length, averaging 18.1 months in Phase II. In contrast, transactions in the Transportation sector accounted for the shortest average duration for significant Phase I investigations at only 5.0 months from announcement to clearance. The relative speed of significant investigations in this sector is further reflected in the average duration of Phase II proceedings; the 10.2-month average for Transportation is only slightly behind the shortest average duration of 10.1 months for Phase II proceedings in the Technology sector.

Phase II proceedings are on average roughly twice the length of Phase I reviews. However, the analysis shows that the increase in duration between Phase I and Phase II varies across industries. For instance, undergoing a Phase II review in the Technology sector adds 4.0 months to the review timetable; whereas the transactions in the Energy sector show the biggest jump with an average increase of 8.6 months.

Conclusion

While the circumstances of any individual transaction will naturally vary from the DAMITT averages, current statistics suggest that parties to the hypothetical average “significant” investigation subject to review only in the U.S. would have to plan on approximately a year for the agencies to investigate a transaction, although the duration of U.S. significant investigations appears to depend to a surprising extent on whether it is the FTC or the DOJ that conducts the investigation. Parties should further allow an additional five to seven months if they want to preserve their right to litigate an adverse agency decision.

Deal timetables for EU cases where the investigation is likely to proceed to Phase II need to allow for a lapse of around 14 months from announcement to clearance. If the investigation is likely to be resolved in Phase I with remedies, the deal timetable should allow for approximately eight months from announcement to a decision.

New DAMITT industry-based analysis demonstrates that the average duration of significant merger investigations varies by industry in both the U.S. and EU. In the U.S, the numbers show that significant investigations can take less than half as long on average in some industries (e.g., Financial Services) compared to others (e.g., Chemicals). In the EU, the duration of significant investigations depends naturally on the likelihood of clearance in Phase I versus Phase II. The existence of clear guidance in the form of long-standing published decisional practice in certain sectors significantly improves the prospect of merger clearance in Phase I.